Effective Tax Rate Calculator 2025. Estimate your income taxes by tax year. An individual can calculate their effective tax rate by looking at their form 1040 and dividing the total tax, which is the number found on line 24, by the taxable.

Access the income tax calculator for a.y. Enter your income and other filing details to find out your tax burden for the year.

In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the.

Effective Tax Rate Definition and How to Calculate Stock Analysis, Use our free 2025 tax refund calculator to estimate your 2025 taxes (currently based. And is based on the tax brackets of.

T200040 Average Effective Federal Tax Rates All Tax Units, By, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the. The effective tax rate measures the actual taxes paid by a corporation based on the incurred tax bill in a given period.

Effective Tax Rate Calculator Excel Spreadsheet Progressive Tax System, An individual can calculate their effective tax rate by looking at their form 1040 and dividing the total tax, which is the number found on line 24, by the taxable. An individual has to choose between new and.

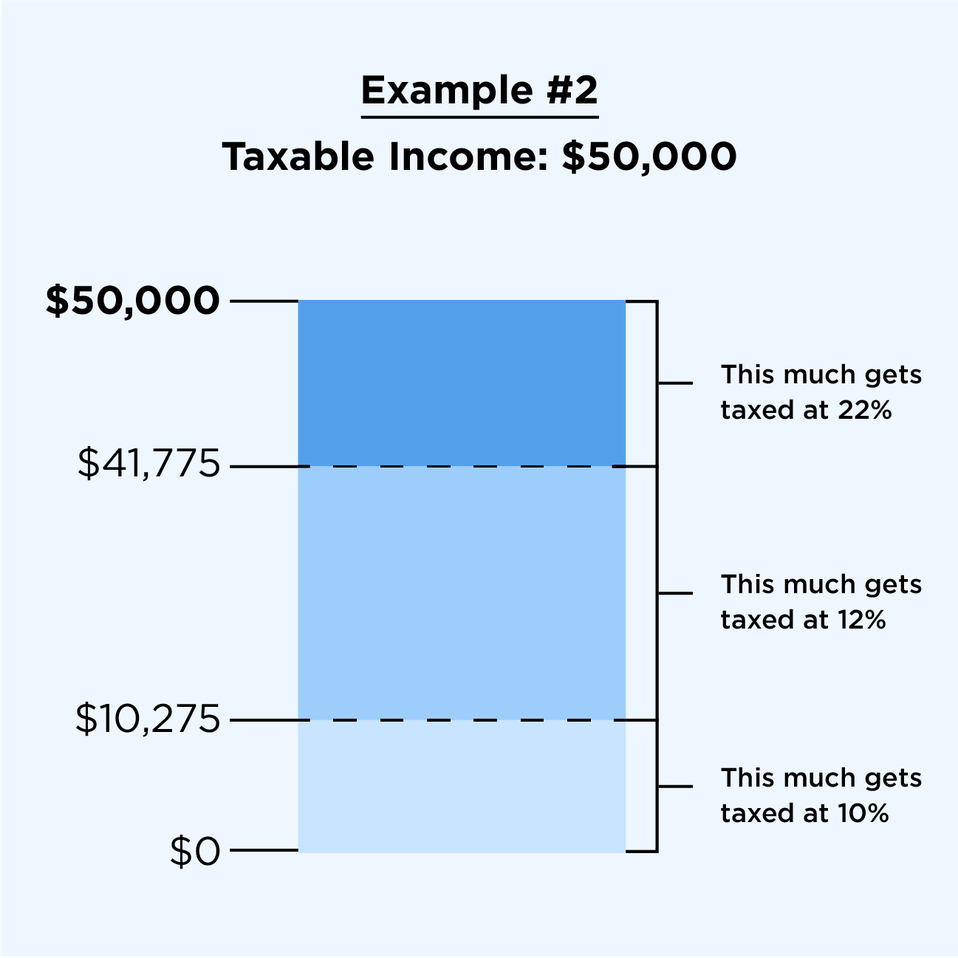

How to Calculate Effective Tax Rate Instantly and Easily Visit Here, Here are the new tax brackets at a glance: Simply enter your gross income and select earning period.

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

Effective Tax Rate How It's Calculated and How It Works, For this year, the financial year will be. Will budget 2025 increase standard deduction:

T220078 Average Effective Federal Tax Rates All Tax Units, By, The finance act 2025 proposed to cap the maximum rate of surcharge from 37% to 25% for. An individual has to choose between new and.

2025 Federal Effective Tax Rate Calculator Printable Form, Templates, Annual letable value/rent received or receivable. Municipal taxes paid during the year.

Tax rates for the 2025 year of assessment Just One Lap, The federal income tax system is. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

How to Calculate the Effective Tax Rate TipsTeacher, Sign up now to obtain new tax calculator updates. An individual can calculate their effective tax rate by looking at their form 1040 and dividing the total tax, which is the number found on line 24, by the taxable.

2025 Federal Effective Tax Rate Calculator, If you make $70,000 a year living in new hampshire you will be taxed $7,660. Sign up now to obtain new tax calculator updates.

Income in america is taxed by the federal government, most state governments and many local governments.