With great pleasure, we will explore the intriguing topic related to ACA Subsidy Income Limits for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

The Affordable Care Act (ACA) provides financial assistance to low- and moderate-income individuals and families to help them afford health insurance. This assistance is in the form of premium tax credits and cost-sharing reductions.

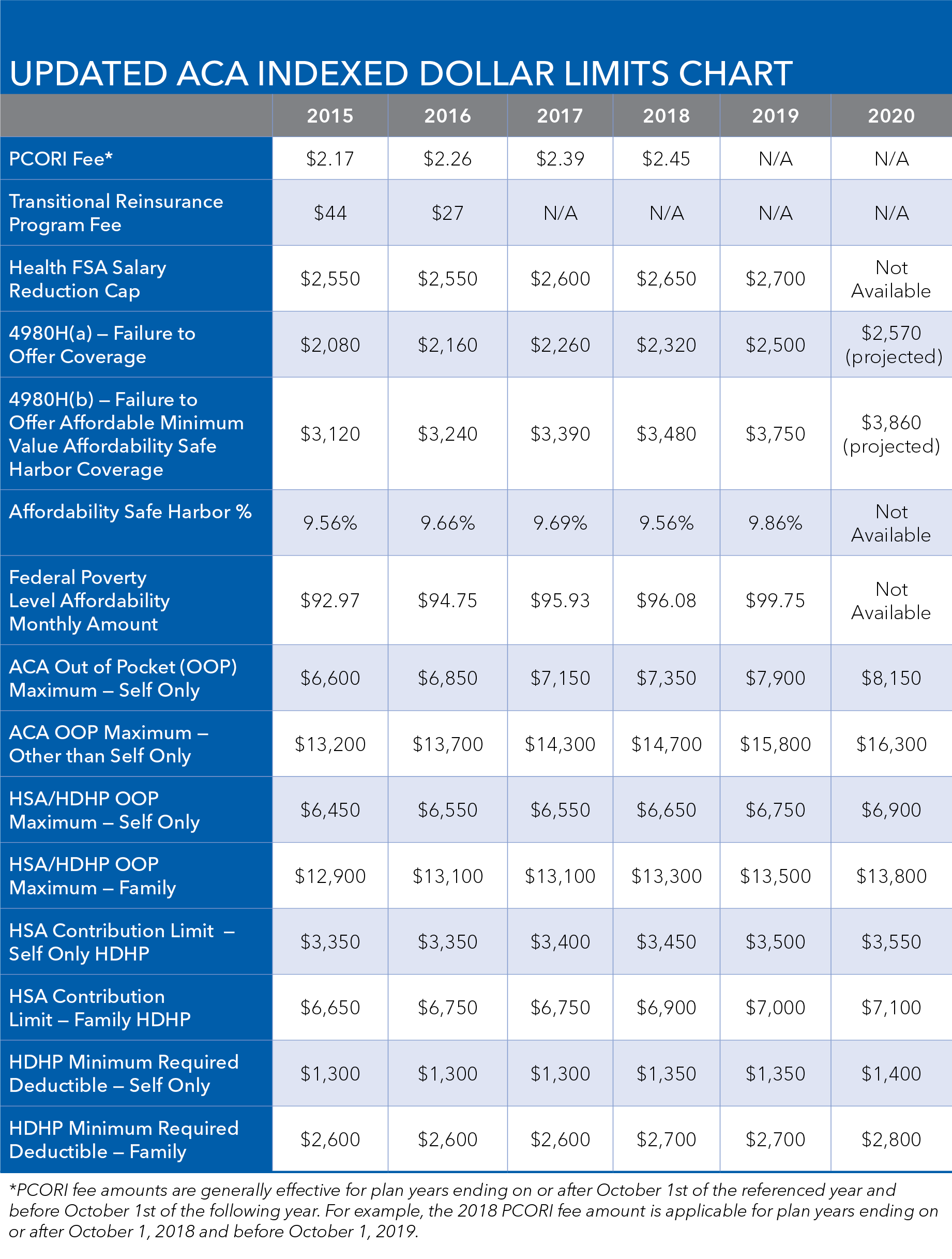

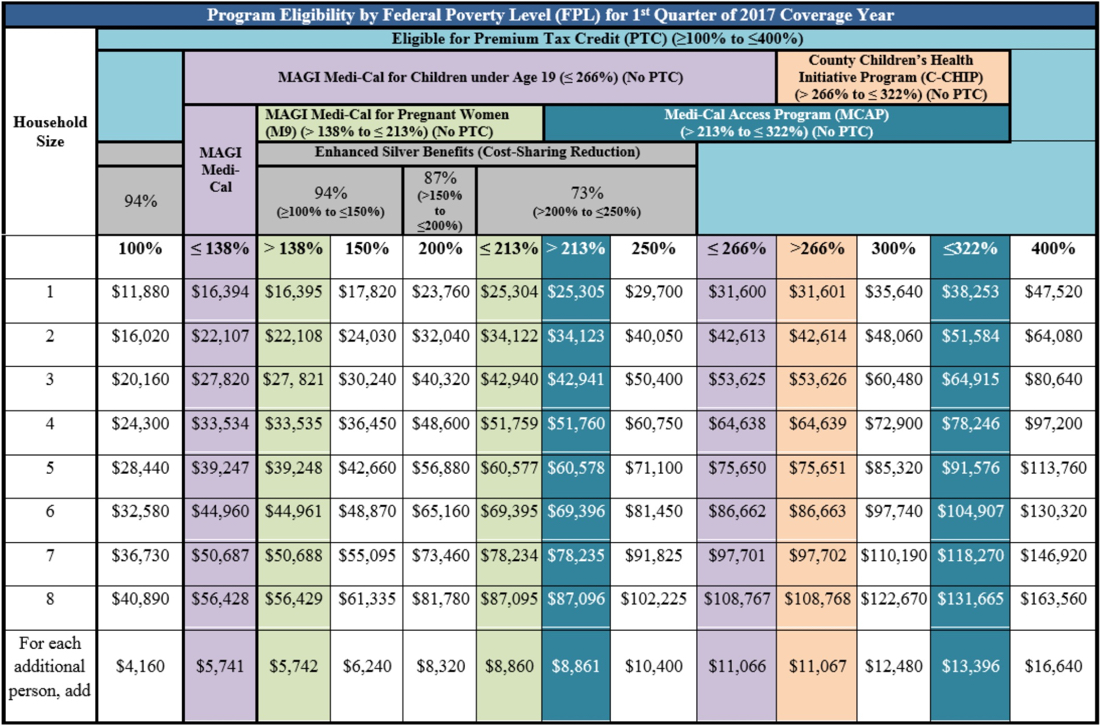

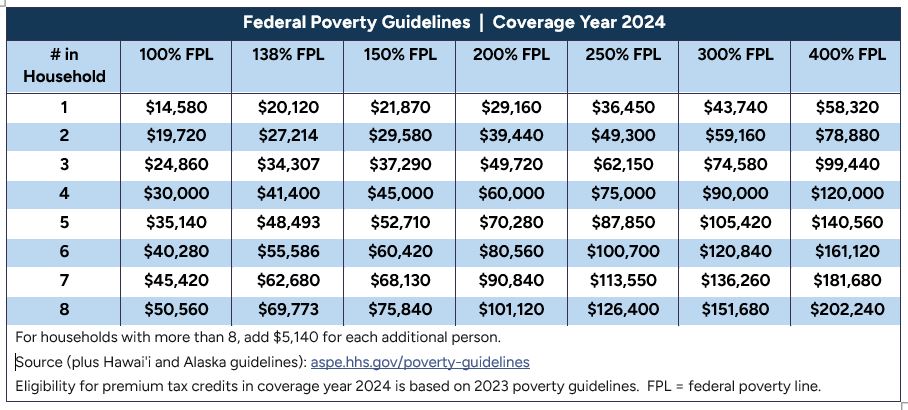

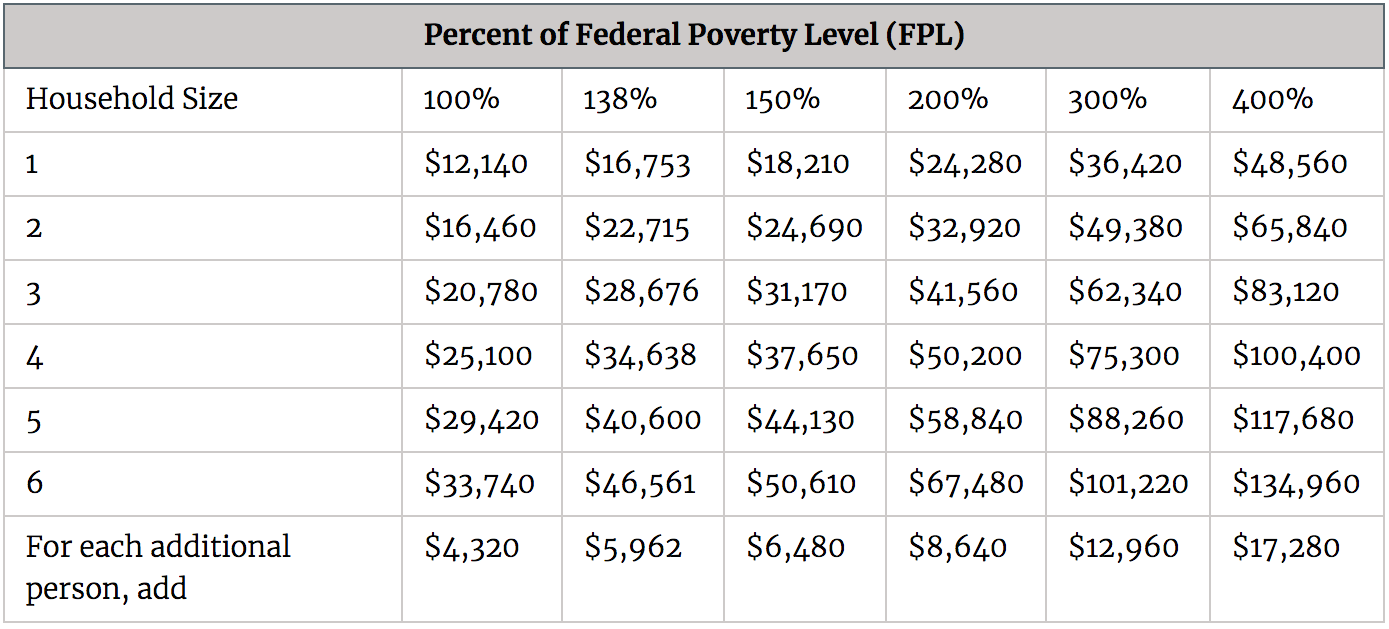

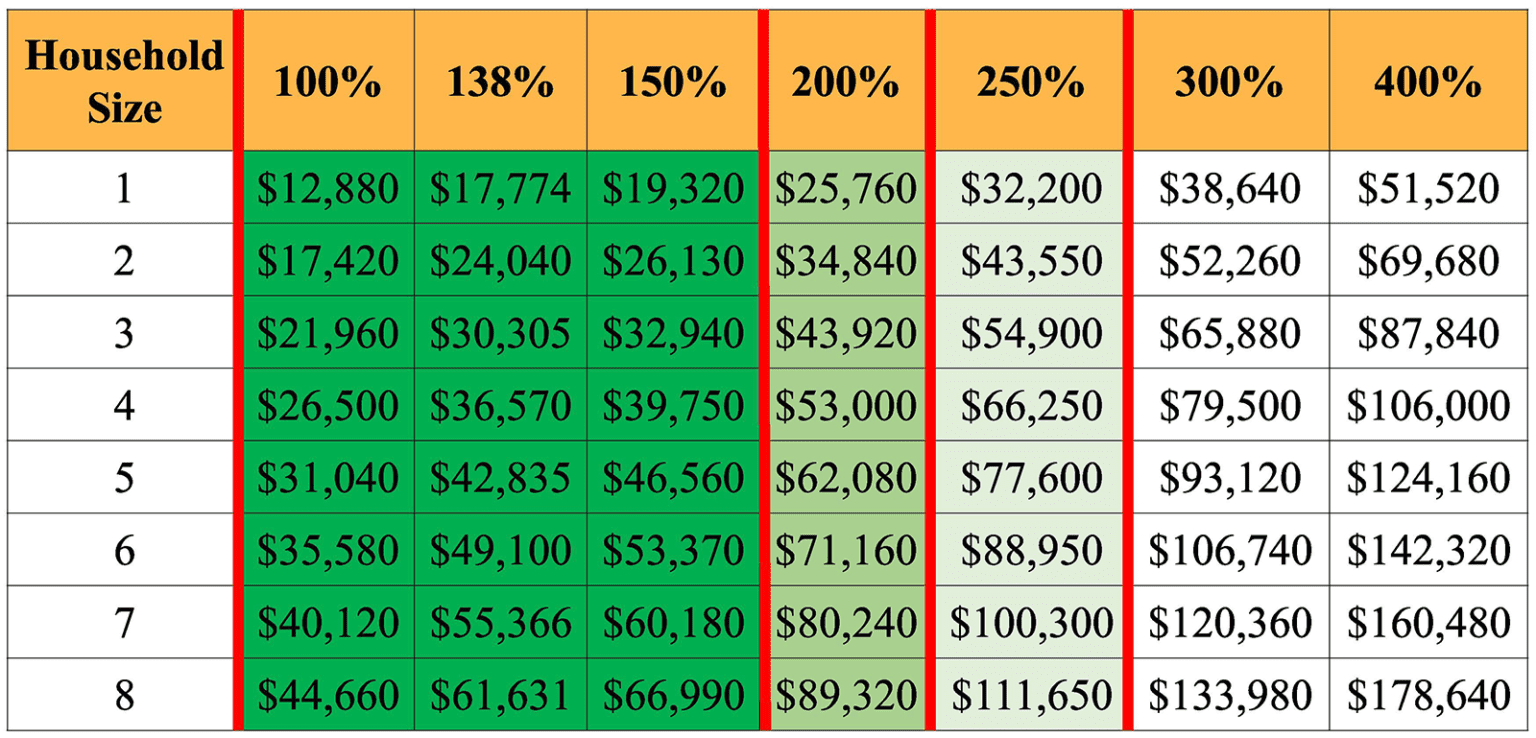

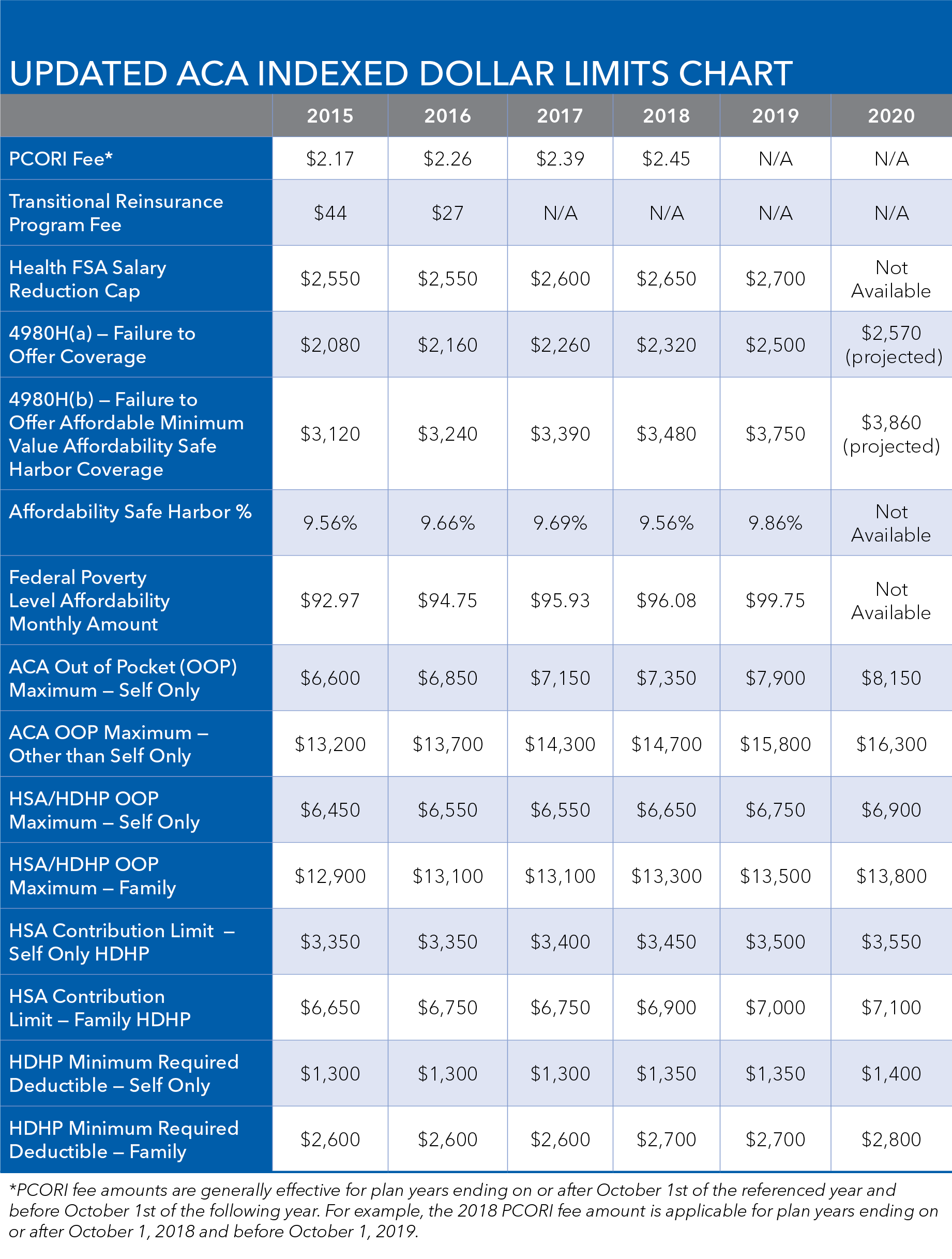

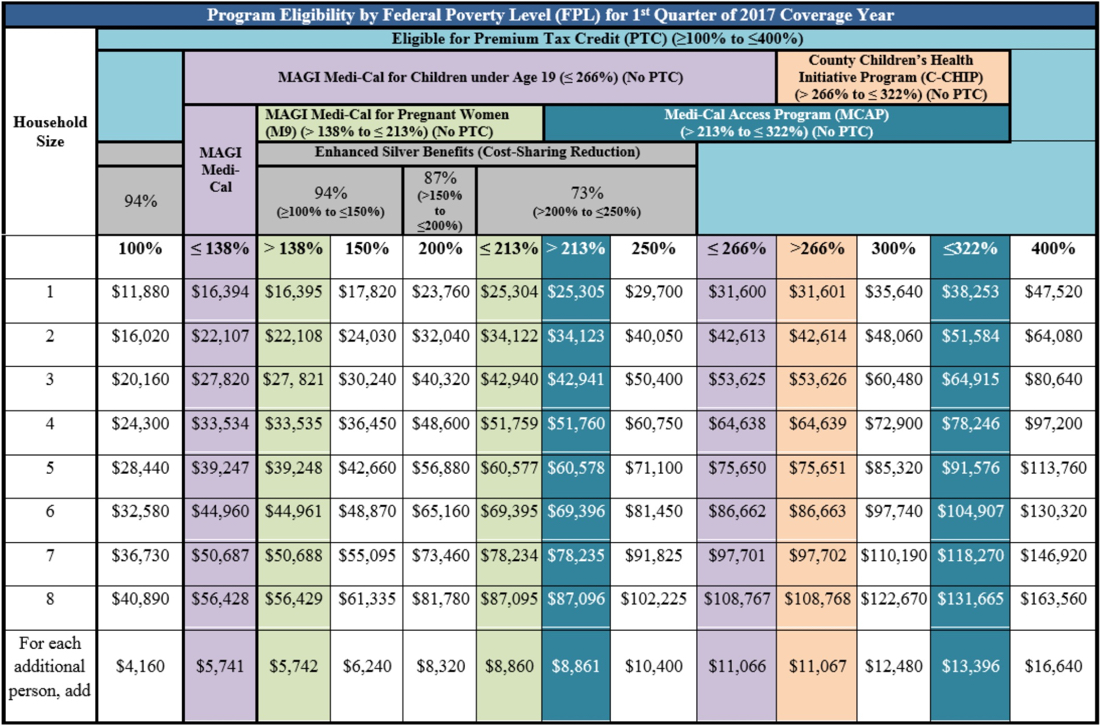

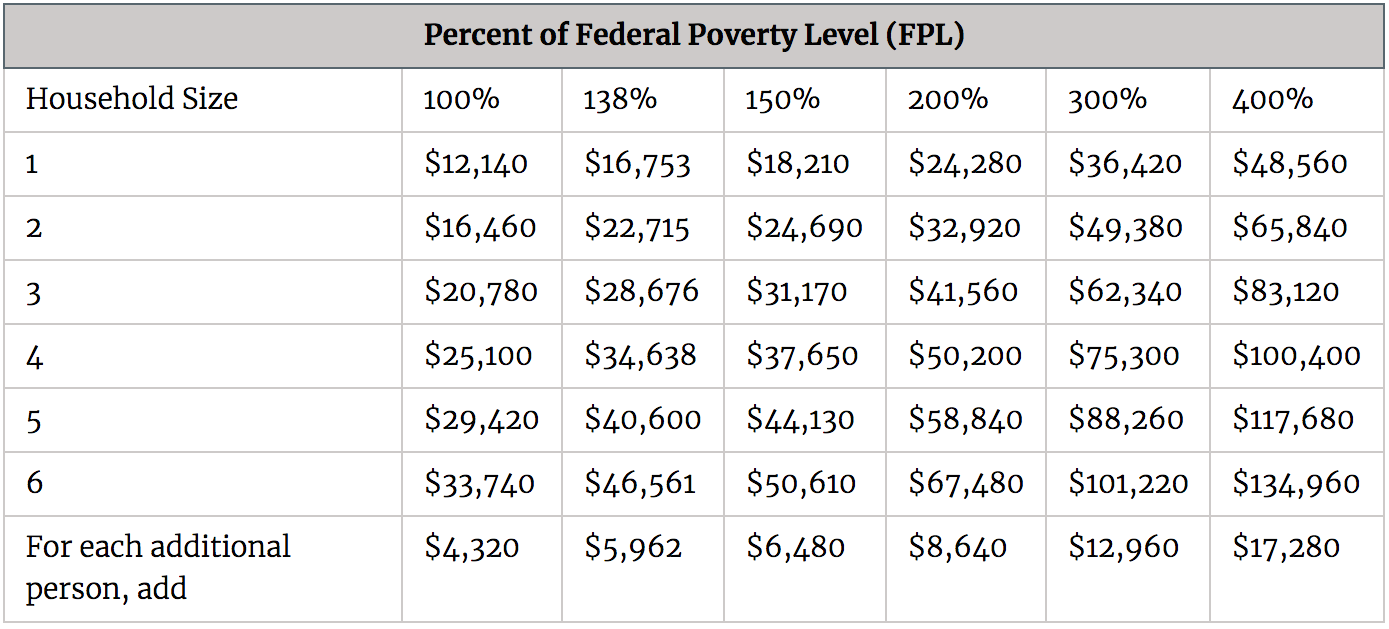

The amount of financial assistance that you are eligible for depends on your income and family size. The ACA subsidy income limits are adjusted each year to reflect changes in the cost of living.

If your income is below the subsidy income limit, you may be eligible for premium tax credits to help you pay for your health insurance premiums. The amount of premium tax credits that you are eligible for depends on your income, family size, and the cost of the health insurance plan that you choose.

If your income is below 250% of the federal poverty level, you may also be eligible for cost-sharing reductions to help you pay for your out-of-pocket health care costs, such as deductibles, copayments, and coinsurance.

To apply for ACA subsidies, you must enroll in a health insurance plan through the Health Insurance Marketplace. You can apply for subsidies online, by phone, or through a paper application.

The amount of ACA subsidy that you are eligible for depends on your income, family size, and the cost of the health insurance plan that you choose.

To calculate your ACA subsidy, you can use the Health Insurance Marketplace subsidy calculator. The calculator will ask you for information about your income, family size, and the health insurance plan that you are considering.

Once you have entered your information, the calculator will tell you how much you are eligible for in premium tax credits and cost-sharing reductions.

Thus, we hope this article has provided valuable insights into ACA Subsidy Income Limits for 2025. We hope you find this article informative and beneficial. See you in our next article!